Our previous story on risk in forex markets went over the definitions of the base.quote currency ticker format and how the quote defines the currency the contract is valued in. In this story I will go through a couple of specific examples to show how to correctly value any forex contract and have it priced in the same currency you use for your accounts.

To begin, imagine you are a United States Dollar (USD) account holder and you want to value a contract to sell AUD.JPY. I am extending the work we went through in an earlier story on the dollar risk of one futures contract by adding the currency conversion rate and converting the quoted currency back to the account currency.

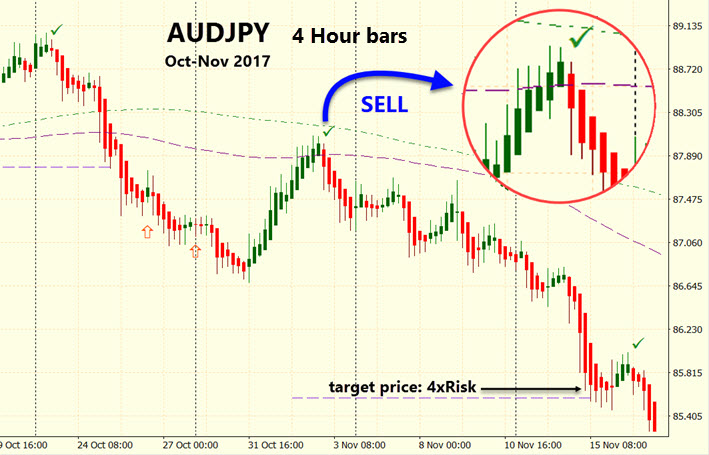

We will use the trade data indicated in the following H4 chart of the AUDJPY:

Here is the trade from the highlighted setup, with the actual open price and stop loss:

Example 1. The Basic Setup for AUD.JPY

Risk per AUD.JPY Contract for a Sample Trade

OP = 87.605 Open Price in Yen

SL = 88.115 Stop Loss in Yen

CS = 100,000 Contract Size

CR = |OP - SL| x CS ¥Contract Risk (absolute value)

= |87.605 - 88.115| x 100K

¥CR = ¥51,000 Risk in Yen

$CR = ¥51,000 x JPY.USD Risk in USD

This last statement says that the risk in dollar terms is equal to the risk in yen multiplied by the cost of each yen. Because there is normally no traded JPY.USD, we have to synthesize it from:

JPY.USD = 1 / USD.JPY

This simply says if the market for USD.JPY is currently trading at 100 then 1000 Yen is worth exactly $10 when valued in US$:

$value = ¥1,000 x (1 / 100) Where 100 is the USD.JPY rate.

= $10 In USD

These calculations are good enough here, but programmers will have to adjust the equations further by swapping the bid/ask rates:

JPY.USD(bid) = 1 / USD.JPY(ask) JPY.USD(ask) = 1 / USD.JPY(bid)

and applying each one correctly depending on whether the adjustment is for a buy (use the ask) or a sell (use the bid). That's a little too much detail for a non-programming article like this so let's just abstract away from the bid/ask for now to stay focused on the general idea.

At the time of the trade above from 2017-11-03 00:00 (written in 24 hour time, the USD.JPY mid close price was 113.95. Using this to value the contract in US$, gives us:

JPY.USD = 1 / 113.95

= 0.0088

$CR = ¥CR x JPY.USD Risk in USD

= ¥51,000 x 0.0088

= US$448.80 Risk per contract in US$

What if your account is based in a currency other than US$? In this example so far we have used the inverse of USD.JPY to convert the Yen profits and losses to US$. If you are in another currency, say XYZ, you have two choices. The simple method is to find a direct currency pair from Yen to your currency, such as EUR.JPY, and replace the JPY.USD in the formula above with 1/EUR.JPY. In general you are looking for either XYZ.JPY or JPY.XYZ. In the case of the latter, there is no need to invert it beforehand.

The second method, useful when no direct cross exists between Yen and your account currency XYZ, is to add an extra step above after calculating the US$ contract risk. This step converts the US$ amount into your local currency. Every currency in the world should have a forex pair linking its currency to the USD, either XYZ.USD or USD.XYZ. If it is the former than invert it to arrive at the rate that converts US$ values into your account currency: USD.XYZ.

¥CR = ¥51,000 Risk in Yen

$CR = ¥51,000 x JPY.USD Risk in USD

CR = $CR x USD.XYZ New: Risk in your XYZ currency

You now have the value of one contract in the same currency as your account. Just continue on below, but substitute your currency symbol for the $ sign.

We now have enough information to calculate the number of contracts to open.

An earlier story showed how to calculate the amount we could invest in a trade without risking more than 2% of our available risk capital. Assuming $100K to invest, we therefore have $2,000 available for this trade. Now finally we can calculate the number of contracts to buy:

Number of contracts = ($Funds at risk) / ($risk per contract)

= 2000 / 448.80

= 4 contracts

Cost of position = $1795.20 from: 4 contracts x $448.80

Example 2. The Basic Setup for AUD.USD

In this example, because AUD.USD is priced in US$, US account holders can view the entire setup as a normal US$ futures contract with a contract size of 100K. But non-US traders will need to convert the US$ contract risk back to their own account currency. Here we consider the case of a trader with Yen accounts, but you could just as easily substitute Euros or any other account currency.

Risk per AUDUSD Contract for a Sample Trade

OP = 0.76910 Open Price in US$

SL = 0.77310 Stop Loss in US$

CS = 100,000 Contract Size

$CR = |OP - SL| x CS $Contract Risk (absolute value)

= |0.76910 - 0.77310| x 100K

$CR = US$400 Risk in USD

¥CR = US$400 x USD.JPY Risk in Yen

= US$400 x 113.95

= ¥45,580

The second last statement says that the risk in yen terms is equal to the risk in US$ multiplied by the cost of each US$ valued in yen. So in this case we have US$400 and each US$ costs ¥113.95.

Now assume the Japanese trader has ¥10,000,000 worth of risk funds in a Yen account to invest, of which only 1% or ¥100,000 can be invested in any one trade.

Calculate the Number of Contracts From Funds Held In Yen:

Number of contracts = ¥Funds at risk / ¥risk per contract

= ¥100,000 / ¥45,580

= 2 contracts

Cost of position = ¥91,160 from 2 contracts x ¥45,580

The Account Currency Conversion is Only Needed to Calculate Position Size

To determine whether the trade hits the target or is stopped out, we only need the contract risk which is provided by the SL and open price. The RR multiplier provides a simple way of getting a TP. So we do not need to mess with quote or account currencies. However whenever we need to calculate the number of contracts in order to open a trade, we need to go through the calculations above.

Another way of doing this is to calculate the value of one pip per contract in the forex rate you are opening. Then multiply that by the number of pips at risk and calculate the number of contracts to be opened. It's the same formula, just executed in a slightly different order.

It is very important to know what you are doing if you want to limit your risk, hence the calculations above. However, you can save yourself a lot of hassle by using one of the many free online calculators. Just search on "forex calculator" when you need one. Here are two to get you started:

Forex Calculators:

Conclusion

I have explained the general format of a currency pair, Base.Quote, and how to assess it as units of the base priced in the quote currency. We walked through how to convert the risk from the quote currency into your local account currency. Finally we were able to calculate the number of contracts to open while at the same time limiting our risk to a small percentage of our risk funds.

With this background in forex contracts we are now ready to consider how we might go about building a simple forex system. That will be the subject of our next story. Stay tuned.

Copyright (C) PagooLABS 2017. All Rights Reserved.